E-Payment solutions

We asked our survey participants which e-payment solution they use. Stripe was the most solution with over 51%.

For the Algerian solutions we have the following:

The government's official solution (SATIM/CIBWeb) is followed by serval startups offering serval payment modules/APIs, Chargily is the second most used solution according to our participants, then followed by SlickPay, and Guidini's e-payment services.

We will explore these options in the following sections, we will explore the usage of these different payment methods.

SATIM

SATIM (Automated Interbank Transactions and Electronic Banking Company) (consumed through CIBWeb) is the most used Algerian Payment solution, it accepts both local credit cards (CIB and EDDAHABIA).

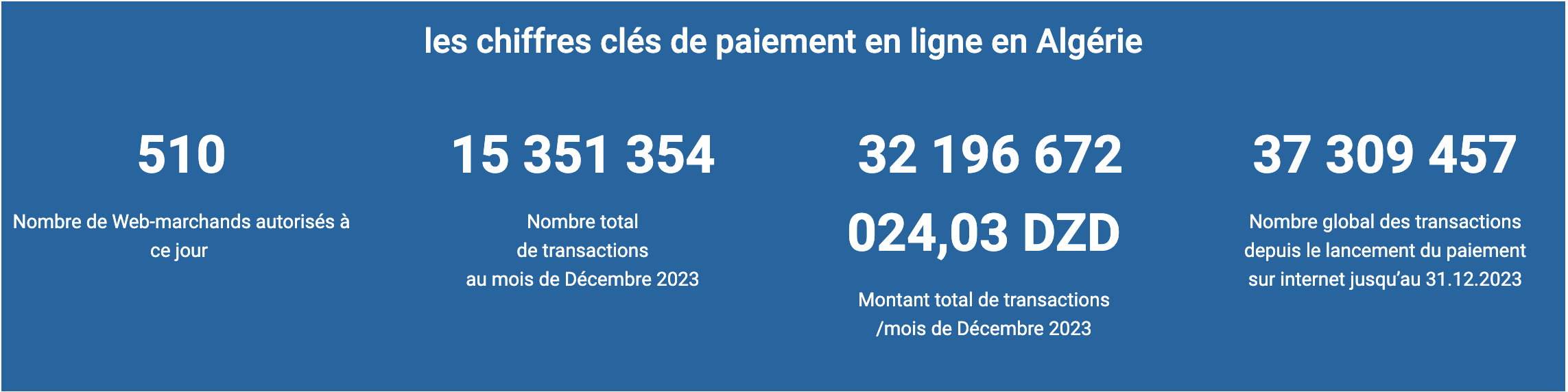

However, this solution seem in its early staged with only 510 authorized clients as of now (May 28th, 2024) according to CIB's website.

Looking into previous screenshots of "cibweb.dz/fr/actualites-et-chiffres-cles" page on archive.org, we notice the following pattern:

The slow increase of these numbers sets the following hypothesis:

- The e-commerce culture is not established yet, businesses are still not online or they don't provide e-payment options.

- The SATIM's processing time and the lack of a clear guidance slows down the adoption, businesses may wait for a long time to implement e-payment solutions and/or to get approved by the authority.

- Businesses use third-party payment providers or other solutions.

The first point is out of scope in our study as it requires a dedicated study. Therefor, we will only focus on the other hypothesis.

According to several interviews we conducted:

- Some developers are not aware of the process of how to integrate e-payment solutions.

- Some businesses tend to postpone e-payment integration with the official SATIM/CIB APIs because of their process and pricing.

The integration with SATIM/CIB lacks a technical documentation, or at least the "technical" promotion of an existing one.

E-payment and CIB search keywords in Algeria are often pointing to third-party services and not the official websites and sources.

Personal in banks are sometimes not aware of the processes, developers and businesses find it challenging to ask their banks for information.

In a interview with a software development agency who's behind a subscription-based solution, we were told that they could not integrate with SATIM/CIB payment solutions since their process takes a lot of time, and it introduces a significant cost.

In another interview with a developer, we were informed that CIB process may take several months, and their test environment is a paid one, which makes it very expensive the longer it's used.

Using third-party payment solutions

SATIM's high entry barriers, the confusion or the lack of information on how to integrate with them, in addition to not promote their solutions between software development communities and agencies created silos.

These challenges and silos created an opportunity for some startups and software development agencies. As SATIM requires businesses to have a payment module, some software development agencies promotes their own modules.

As of May 2024, we counted 81 authorized e-payment modules. These modules are provided by software development agencies who offer their solutions as a feature in their products, while other companies launched dedicated startups for this need.

Such startups promise a better developer experience with their APIs, their libraries and their lower initial costs.

These startups promote their solutions in developer communities, and promise to have a better developer experience. However, some developers and businesses still don't trust them due to the lack of a clear legal framework for their practices.

In an interview with a representative of one of these startups we learned that no special audit or certificates were required for them to operate apart from SATIM's to get them approved.

Some of these application APIs endpoints are hosted abroad, and are served from non .dz domains, which might not be compliant with Algerian laws, or at least they operate in "gray areas" of the Algerian legislation.

Using Baridimob and Baridiweb services

Some businesses use Baridimob and BaridiWeb as a solution to send and receive payments, as an electronic payments solution.

The daily limit was upgraded from 50K DZD, to 200K DZD since July 2023.

Transfers are subjected to a varying fee depending on the specified amount, fees are mentioned in Algérie Poste website's FAQ page.